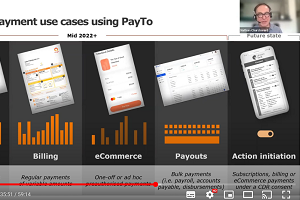

As more banks (and by extension millions of customers) progressively connect to the PayTo ecosystem, attention is shifting to those businesses that have been enabled as PayTo Users and the innovative use cases that they are bringing to market.

But in an ecosystem of directly and indirectly connected participants, what pathways are open to businesses to access PayTo and the New Payments Platform (NPP)? And what role do different PayTo Users play in the creation, initiation and settlement of payments?

In this article we aim to shine a light on these questions.

The PayTo ecosystem

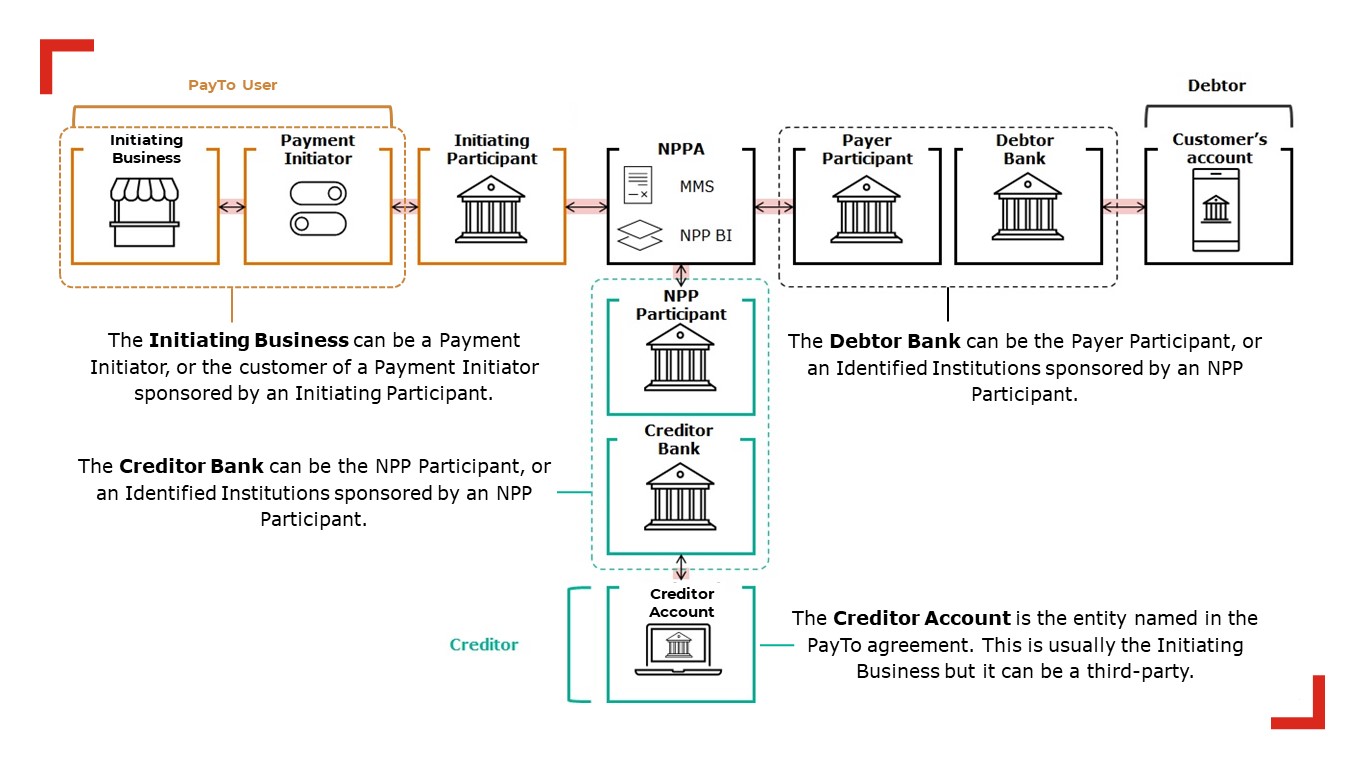

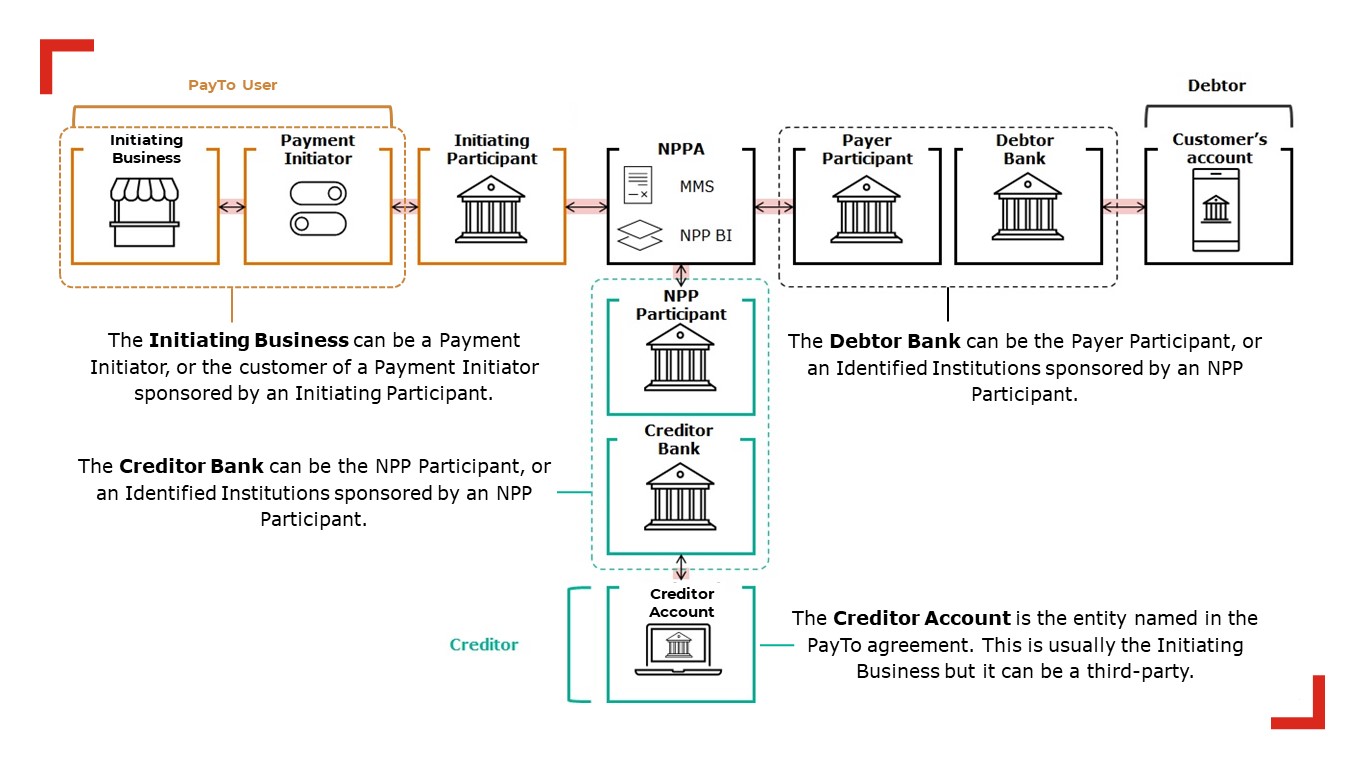

PayTo is an interconnected network of participants that connects customers, business and their financial institutions, facilitating the creation of PayTo agreements and ensuring the smooth flow of payment initiation requests and settlement of funds in real-time.

Figure 1: PayTo participant ecosystem

While banks are instrumental when it comes to facilitating the authorisation and management of PayTo agreements by customers and settling funds when valid payment initiation requests are received, PayTo Users are the main players when it comes to the creation and initiation of PayTo agreements.

PayTo Users

In the PayTo ecosystem there are two types of PayTo Users: the Initiating Business and the Payment Initiator.

Initiating Businesses are responsible for entering into PayTo agreements with the debtor customer, defining the PayTo agreement terms that will be registered in NPPA’s Mandate Management Service (MMS) and authorised by the customer through their digital banking channel, and initiating requests for payment in accordance with the agreed terms.

Payment Initiators are responsible for the exchange of PayTo agreement creation and payment messages to/from the Initiating Businesses with the wider PayTo ecosystem, via APIs provided by the sponsoring Initiating Participant.

Initiating Participants

To access PayTo as a Payment Initiator, businesses need to be sponsored by an Initiating Participant: either a Connected Institution or an NPP Participant or Identified Institution that has been certified as a Payment Initiator.

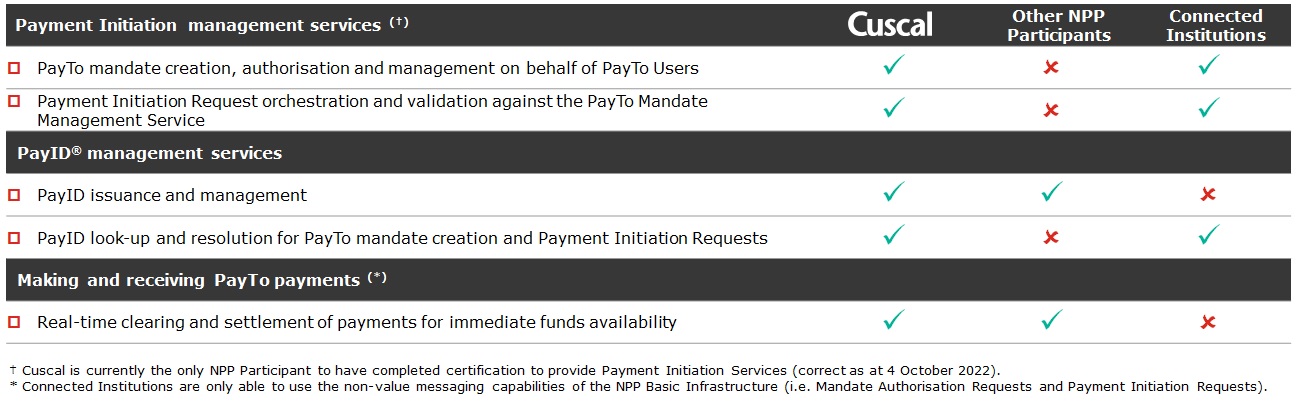

Connected Institutions are only able to use the non-value messaging capabilities of the NPP Basic Infrastructure to create a PayTo mandate and send a Payment Initiation Request. They cannot clear or settle payments or issue or manage PayIDs.

NPP Participants and Identified Institutions that have been certified as a Payment Initiator have access to all flows and options for NPP messaging and services, delivering end-to-end payment initiation, PayID issuance and management, and clearing and settlement services through a single provider.

Clearing and settlement services can only be provided by an NPP Participant licensed by APRA as an Authorised Deposit-Taking Institution (ADI)This helps to keep payments safe because as ADIs, NPP Participants meet the prudential requirements set by the Australian Prudential Regulation Authority (APRA) to operate in the regulated payments environment and have access to RBA settlement facilities. Like in other payment systems, the NPP Participant can sponsor other organisations to provide clearing and settlement services on their behalf, and in the NPP, these entities are referred to as Identified Institutions.

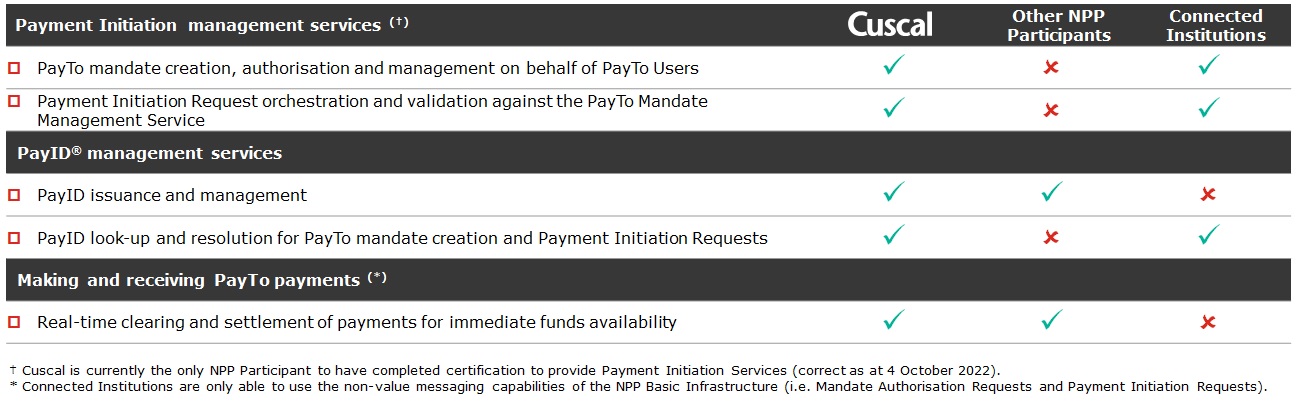

Figure 2: Cuscal NPP services compared to other directly connected participants

Figure 2: Cuscal NPP services compared to other directly connected participants

Why Cuscal

As the first directly connected participant to be certified by NPP Australia (NPPA) as an Initiating Participant and Payer Participant, Cuscal plays a unique role in the PayTo ecosystem.

As a certified Initiating Participant, Cuscal connects high volume and high growth businesses, payment service providers, platforms and payment facilitators to the NPP as Identified Institutions and Payment Initiators, providing access to all the features of the NPP under a sponsorship arrangement. Businesses can connect to PayTo as an Initiating Business through a Payment Initiator under a proprietary commercial arrangement with a Payment Initiator that has been connected to the Platform by Cuscal.

As a certified Payer Participant, Cuscal provides banks, credit unions and mutual banks with access to the services required to receive, process and manage PayTo agreements and payment initiation requests, as well as the infrastructure required to clear and settle payments.

At Cuscal we have been helping our clients to access Australia’s payment systems with innovative solutions for over 50 years. As the market leader in providing NPP services, with over 4 years NPP experience enabling 60+ implementations since 2018, we’ve helped more organisations to access the NPP than anyone else, including more than half of all financial institutions and all of the payment service providers that are providing payments on the Platform today.

With the launch of PayTo, Cuscal has the scale, expertise, trusted industry position and comprehensive real-time account-based payment and payment initiation solutions required by Payment Initiators.

To find out more about connecting to PayTo as a Payment Initiator and how you can provide PayTo services to your business customers, contact Cuscal.

Figure 2: Cuscal NPP services compared to other directly connected participants

Figure 2: Cuscal NPP services compared to other directly connected participants