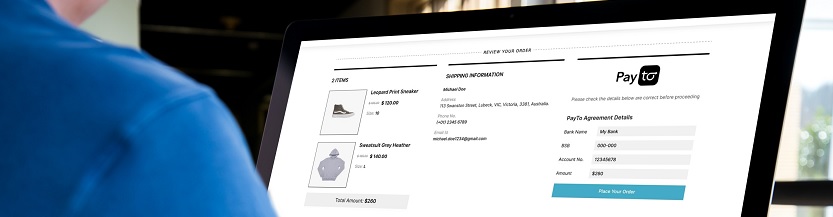

The rollout of PayTo capabilities to online banking channels, with Great Southern Bank leading the way, has sharpened focus on ‘how’ and ‘why’ businesses should become initiating participants to enable real-time and future dated payments from their customers’ bank accounts.

In this post we look at how PayTo can help initiating businesses thrive in a digital economy with fast, reliable and secure payments that keeps money moving 24/7.

The case for PayTo

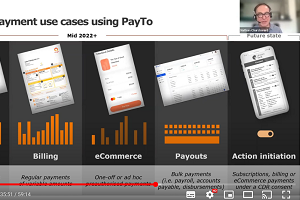

As an enabler of real-time digital commerce, PayTo supports a broad range of use cases, delivering tangible benefits for the initiating business, including:

Explicit customer authorisation before any payments can be processed from bank accounts, addressing one of its biggest payment challenges facing businesses today; the requirement for consent via Strong Customer Authentication to reduce the risk of fraud, unauthorised payments and chargebacks.

Message response times that are delivered in seconds, confirming that valid account details have been provided, that payment has been authorised by the account owner, and that funds are available at time of payment, improving the certainty of successful payment outcomes for the initiating business.

The real-time settlement of funds at time of payment to improve cashflow availability for reinvestment in the business.

From an operational perspective the data-rich ISO messaging capabilities of the NPP enables more precise transaction data to be included within payment initiation and clearing and settlement messages. Data that more accurately describes the terms of the payer customer’s authorisation, including; payment type (recurring, one-off or ad hoc), any ultimate creditor’s name, descriptions and creditor’s reference(s), all support the easier reconciliation of payments. This also provides richer data insights that businesses can use to tailor their products and services to optimise customer experience.

The format of PayTo mandates and the data that can be included offers significant benefits in terms of data quality and visibility, compared to the relatively opaque nature of direct debit arrangements established under the BECS Direct Entry system, particularly if the payment is being facilitated via an intermediary.

Taken individually, each feature of a PayTo mandate improves an aspect of the payment experience. Taken together they can help lower the total cost of payment acceptance for the initiating business.

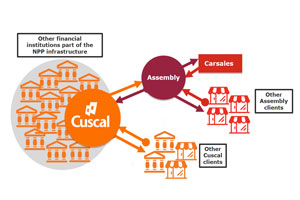

How to connect to PayTo as a Payment Initiator or Initiating Business

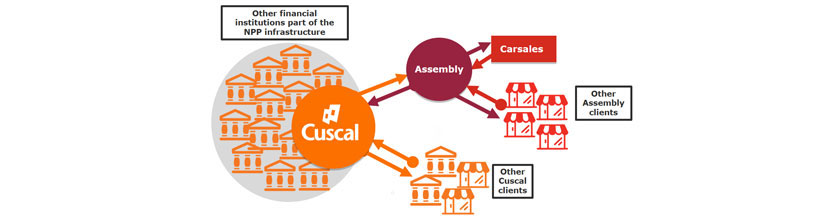

Payment service providers, platforms and payment facilitators that process payments on behalf of other businesses, as well as high volume and high growth businesses that process their own payments, can connect to PayTo as a Payment Initiator through Cuscal, the market leader in NPP. Benefits include:

- Only one access point required to initiate payments with all financial institutions connected to the NPP.

- APIs supporting seamless integration and straight-through processes.

- Structured data capabilities to support automated reconciliation.

- Centralised, secure storage of PayTo mandates reducing the reputational risk from payments data breeches.

Other businesses can connect to PayTo as an Initiating Business through a Payment Initiator, benefiting from:

- Real-time account validation when a mandate is created.

- PayTo authorisation by the account owner through secure bank channels.

- Real-time funds verification at the time of payment.

- Real-time notification of payment outcomes.

- Faster settlement compared to other payment methods.

- Integration of notifications into customer service and support processes when a PayTo mandate is paused, changed or cancelled.

With PayTo now live in banking channels are you ready to transform your business with PayTo? To find out more about connecting to PayTo as a Payment Initiator, contact Cuscal.