- Published

- 20 Jan 2025

In July 2020, the New Payments Platform (NPP) celebrated the registration of the 5 millionth PayID. In reaching this milestone I thought it would be interesting to look at the correlation between PayID registration and customer use and engagement. An analysis of the data we’re seeing for payments processed by Cuscal’s NPP solution tells a really positive engagement story.

Cuscal provides NPP services for 40 financial institutions that operate more than 50 banking brands. Partnering with Identified Institutions and NPP Participants our clients range in size, serve a variety of customers and are geographically distributed across Australia, offering a good representative sample of the Australian banking customer base. In fact, Cuscal processes more than 20% of all NPP payments and Cuscal’s clients have registered more than 25% of the 5 million PayIDs.

Our personal banking clients have been very successful in promoting PayID registration and Osko® to their customers, and now these banks, credit unions and their customers are benefitting from the convenience of making and receiving payments in real time.

Here are some interesting shifts that have happened between January and July 2020 in the transactions that Cuscal has processed for our personal banking clients.

Receiving payments

While the overall number of PayIDs registered is increasing, what is even more valuable are the numbers that show customers are actively sharing their PayID with others when they wish to receive money to their account and are receiving Osko payments with increasing regularity.

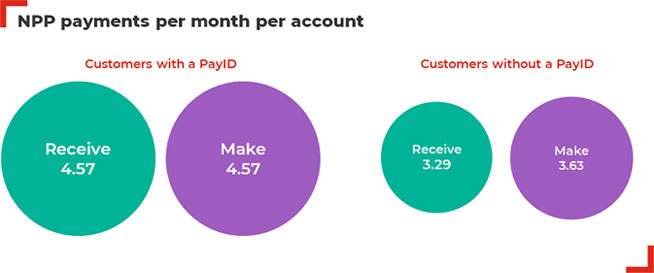

Looking beyond the payments that are received using a PayID, the numbers show that customers with a PayID also receive more NPP transactions generally, indicating that they are more engaged with their bank and the use of their account.

Making payments

Because PayID usage increases once people see how convenient it is, it’s interesting to note that customers that have a PayID also tend to make more payments overall.

Why this is important for banks

As technology continues to transform many aspects of our daily lives, and digital adoption accelerates in response to COVID-19, customers see the value in being able to manage their everyday banking needs at their fingertips. The ability to make or receive payments in real time from their accounts using the NPP with Osko and PayID are the types of services that customers now expect to find in digital banking. Banks that have actively promoted PayID and Osko services to their customers are their accounts and using their digital banking services. Ultimately this is leading to greater customer engagement and satisfaction.

By Nathan Churchward, Head of Emerging Services